APTOSE - Excitement for EHA 2021 Data for Its BTK Inhibitor, Luxeptinib, for Blood Cancers

- Amp Team

- Jun 10, 2021

- 7 min read

We analyzed the abstracts and related stock moves associated with the 2021 European Society of Hematology annual meeting (EHA21) to identify potential stock plays associated with this large biomedical conference (See our BPIQ.com EHA21 Investors Guide HERE). The abstracts for EHA were released on May 12, 2021. The meeting is being held virtually this year, on June 9-17. One company that stood out to us is APTO, especially for the updated data that it is about to present at EHA21 for its reversible Btk kinase inhibitor, Luxeptinib (CG-806).

Although APTO was not one of the stocks whose price increased by more than 10% relative to biotech indices with abstract release (See our BPIQ.com EHA21 Investors Guide HERE), to us that potentially relates to the fact that APTO's data in its EHA21 abstract (See B-cell trial abstract here and AML abstract here) was from a December 4, 2020 cutoff, close to its data release at the American Society of Hematology (ASH) 2020 meeting. However, data is accumulating regularly now for its current phase 1 dose escalation trials of Luxeptinib in certain blood cancers. APTO's data update at EHA21 provides an exciting catalyst (up or down) for the stock. That's why we named it one of our BPIQ.com June 2021 Big-Mover catalyst events (See here).

Although Luxeptinib is in its initial dose escalation Phase 1A/B trial in relapsed or refractory B-cell malignancies (NCT03893682), investors who are experienced in blood cancer therapeutics know that phase 1 data can be very impactful on biopharma companies that are mid-cap or smaller in size. Conditional FDA approvals can occur without as many trials as other disease areas. And typically for these companies, clinical readouts for each clinical asset can have a significant impact on stock price. APTO has 2 clinical assets currently (See FIG. 1), and Luxeptinib is likely driving most value currently.

FIG. 1 APTO clinical asset pipeline (BPIQ.com)

Bruton Tyrosine Kinase inhibitors (BTKis) have transformed the treatment of patients with chronic lymphocytic leukemia (CLL) and other B-cell malignancies by inducing durable responses, improving quality of life and prolonging overall survival (See HERE). With respect to BTK inhibitors, Ibrutinib (sold by Abbvie and J&J under the brand name Imbruvica®), a covalent inhibitor, is a top 10 therapeutic in sales, with over $8 billion in sales in 2019 (See HERE). Prolonged use of BTKi in the real-world setting is limited by toxicity and acquired resistance. Discontinuation rates for BTKis may be as high as 40% in relapsed/refractory CLL, with BTK C481-mediated resistance evident in many progressing patients (See HERE). Alternative therapies such as venetoclax are associated with on-target (BCL2) acquired resistance (See HERE). Luxeptinib (CG-806) is a potent, non-covalent oral inhibitor designed to target BTK and FLT3. It suppresses BCR signaling pathways (through inhibition of LYN, SYK, BTK, AKT, ERK) in cell lines and primary CLL cells, kills malignant B-cells insensitive to ibrutinib or venetoclax at low nM concentrations, and shows enhanced activity in combination with venetoclax (See HERE).

With respect to APTO/CG-806 (Luxeptinib), the obvious comparison for experienced smid-cap biopharma investors is to ARQL/ARQ531 and LOXO/LOXO-305. Both ARQL531 and LOXO-305 are non-covalent BTK inhibitors that are in clinical trials for B cell malignancies (See Table 1). Vecabrutinib is another non-covalent BTK inhibitor that was in early-stage clinical trials (See Table 1). Both ARQL and LOXO were acquired by large pharma companies for hefty multiples based in part, on their Btk inhibitor assets.

Table 1. Non-Covalent Btk Inhibitors in clinical trials

It is important to note that although these clinical assets are all non-covalent BTK inhibitors, they can behave very differently in the clinic. As is typical for kinase inhibitors, these inhibitors are not specific for 1 kinase, but rather inhibit other kinases in addition to BTK, each having a unique kinase inhibition profile. (See FIG. 2 for the kinase map of CG-806). This can result in very different clinical results using these inhibitors. ARQ 531 and LOXO-305 have yielded acceptable safety/tolerability and impressive efficacy in clinical trials on patients with B cell malignancies, including those that are refractory to covalent BTK inhibitors. However, Vecabrutinib, has not.

FIG. 2 Kinase map of CG-806 (For a side-by-side of CG806 and ARQL 531 see Amp Biotech Research's views here: Is Aptose a Good Bet Going Into EHA21 Presentations? (BPIQ Pro or free 30 day trial required -click here to sign up and get access

As far as safety, although SNSS reported that Vecabrutinib was very well tolerated, there appeared to be more treatment emergent adverse events (TEAEs) with Vecabrutinib treatment than the other non-covalent BTK inhibitors. Vecabrutinib common grade TEAEs included anemia in 35% of patients, headaches in 28% of patients, and night sweats in 24% of patients. While ARQL did report Grade 3 or 4 TEAEs in the ARQ 531 trial, these were all in less than 8% of patients. The most common TEAEs for CG-806 were nausea (37.5%) and diarrhea (25%), both common grade events. There was one case of Grade 4 hypertension, but this patient had pre-existing hypertension and the treatment was not the cause. LOXO-305 resulted in just two TEAEs, with 16% of patients experiencing fatigue and 15% experiencing diarrhea. (Links to associated posters and press releases can be found in the bottom row of Table 1). As far as efficacy, ARQL reported an impressive ORR of 89% (8/9) in CLL patients treated with the higher doses in its Phase 1 trial, including 7 of 8 harboring the difficult BTK-C481S mutation (FIG. 3). Lilly/Loxo reported an ORR of 77% in 26 B cell cancer patients treated with LOXO-305 that had at least 6 months of follow-up, with responses improving over time (FIG. 4). On the other hand, the Vecabrutinib response rate was 0% (FIG. 5).

FIG. 3 ARQ 531 Waterfall data

FIG. 4 LOXO-305 Waterfall data

FIG. 5 Vecabrutinib Waterfall data

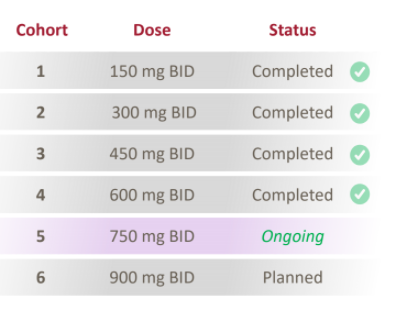

As far as APTO, Luxeptinib's safety has looked acceptable despite a Grade 3/4 blood pressure scare that now appears not to have been caused by the drug candidate. As far as efficacy, although efficacy data has been slow coming, this is a dose escalation trial started at pretty low doses (FIG. 6), and some efficacy signals are emerging.

FIG. 6 Dose cohorts for Luxeptinib Phase 1 dose escalation trial.

In its March 2021 call, APTO reported the following "You will recall that during ASH in December and earlier this year, we highlighted a follicular lymphoma patient, who began to experience reductions in tumor size after escalation of their dose from 450 milligrams to 600 milligrams twice daily. That patient continues now on study for more than a year and has been – has seen continued reduction over multiple scans." (emphasis added; See APTO Q4 2020 transcript on Seeking Alpha).

Luxeptinib's inhibition of FLT3 kinase in addition to BTK, may be an important differentiator for this therapeutic candidate over other BTK inhibitors. Luxeptinib (CG-806) is a potent oral small molecule inhibitor of the wild type and all mutant forms of the FLT3 kinase, including ITD, D835Y, and F691L (See here). Luxeptinib simultaneously suppresses additional signaling pathways in AML cells (CSF1R, PDGFRα, TRK, SYK, BTK, LYN, AKT, ERK, MAPK), kills primary AML cells insensitive to other FLT3 inhibitors at pM and low nM concentrations, and shows enhanced activity in combination with venetoclax. Patient-derived AML cells retain sensitivity to luxeptinib even when harboring mutations of NPM1, IDH1, ASXL1, or TP53. Thus, in addition to the B cell malignancies trial related more to its BTK inhibition activity, Luxeptinib is being evaluated in a Phase 1a/b trial in patients with relapsed or refractory (R/R) AML (NCT04477291). In its first cohort, which was started at a much higher dose than the first cohort of the B cell trial, APTO reported the following on the Q1 investor call: "At the first dose level of 450 milligrams BID, we observed exposures leading to meaningful inhibition of multiple oncogenic driver kinases by plasma inhibitory assay or PIA assay, as well as encouraging anti-leukemic activity, including a patient with a marrow complete response who remains on study after multiple cycles with no apparent safety signals."

As far as competition, there are now three FDA-approved oral, covalent BTK inhibitors (BTKis) in the USA: Ibrutinib (brand name Imbruvica®; manufacturers Janssen, Pharmacyclics, and AbbVie), acalabrutinib (Calquence®; Acerta and AstraZeneca), and zanubrutinib (Brukinsa®; BeiGene). However, the covalent inhibitors are not really direct competitors, as LUXEPTINIB, like other non-covalent inhibitors, at least for now, are for patients who are refractory to covalent inhibitors. Thus, LOXO-305 and ARQ-531 are direct competitors. We searched our pipeline screener on BPIQ.com for other small and mid-cap biopharma companies developing BTK inhibitors for treating cancer. Although we found 3 other smid-cap biopharma companies, NRIX, SRNE, and TGTX with therapeutics that target BTK in development for cancer (FIG. 7), none of them are non-covalent/reversible inhibitors. On the other hand, Genentech is developing a reversible BTK inhibitor, Fenebrutinib (GDC-0853), for the treatment of CLL and other blood cancers (See Dispenza "The Use of Bruton’s Tyrosine Kinase Inhibitors to Treat Allergic Disorders" (2021) HERE). Overall, the non-covalent BTK inhibitor space is getting very competitive. However, as mentioned previously, each of these has unique properties that could differentiate it. It will be interesting to see whether Luxeptinib's dual inhibition of Btk and FLT3 will be a positive differentiator.

FIG. 7. Btk inhibitors in clinical trials identified using pipeline search tool on BPIQ.com

As far as cash runway, APTO appears to be pretty well-funded currently. With over $100M in cash and a burn rate of less than $20M/quarter (see FIG. 8), APTO has over a year of cash. Of course dilution is always a risk, especially if APTO's stock increases significantly on positive data. The biggest risk for investors, however, is that LUXEPTINIB fails in clinical trials, and never reaches market. This would have a huge impact on APTO stock value.

FIG. 8. APTO company page on BPIQ.com.

In summary, for APTO, the major biomedical conference EHA21 could be a stock driver event (up or down) because they are presenting new data for both of their LUXEPTINIB blood cancer trials. The mechanism of action (BTK inhibitor) for LUXEPTINIB in certain blood cell malignancies appears to be well established. Of course, as Vecabrutinib demonstrates, inhibition of BTK in preclinical studies, does not necessarily mean success in the clinic. We are excited to see the updated LUXEPTINIB data later this week at EHA21.

Are you interested in more analysis of the bull and bear viewpoints going into the APTO EHA readouts? See Amp Biotech Research's views here: Is Aptose a Good Bet Going Into EHA21 Presentations? (BPIQ Pro or free 30 day trial required -click here to sign up and get access)

Comments