More Biopharma Stock Ideas from Q3 Hedge Fund Activity

- BPIQ

- Dec 20, 2023

- 2 min read

You can find updated Q3 bioHF holdings data at app.bpiq.com/hedgefunds

Check out the ticker screener

If you are an Elite or Amp subscriber ...

Check out the tables at the links on the left menu under "Hedge Funds"

If not, sign up today HERE

Our goal is to help you make $$ investing in biopharma

That's why we follow top biopharma hedge funds (bioHFs) ^1

Here are some tickers to check out based on Q3 hedge fund activity

Tickers most initiated or closed by bioHF in Q3 '23

Most initiated

$RYZB $APGE $TSHE $SGMT $IMVT $SLNO $CMPS $GOSS

Most closed

$BDTX $VIR $THRX $MRSN

More details ...

👇 Initiated by the most bioHFs in Q3 '23

• Based on 9/30/23 13F filings

⇨ 2 newly IPOed

RYZB (10 vs. 0) (# bioHFs that held ticker on 9/30/23 vs. 6/30/23)

9/19/23 IPO

Ph1 SCLC & endocrine tumors

RYZB pipeline

APGE (9 vs. 0)

7/13/23 IPO

Ph1 Atopic derm

APGE pipeline

⇨ 1 more with very early stage assets

TSHA (8 vs. 0) (^2)

Ph1/2 Rett Syndrome

TSHA pipeline

⇨ 1 whose stock took a big plunge since end of Q3

SGMT (5 vs. 0)

Stock heading down since end Q2 (~12.50 to ~$3.63) but no readouts?

Upcoming Ph2b catalyst (Q1 2024) in NASH

SGMT 1 yr stock chart

⇨ 2 that had big mover positive readouts near end of last quarter

IMVT (14 vs. 6)

9/26/23

Ph1 auto-immune disease

IMVT-14-2 anti-FcRn Ab for various auto-immune diseases

pipeline in asset-type asset

IMVT 1 yr stock chart

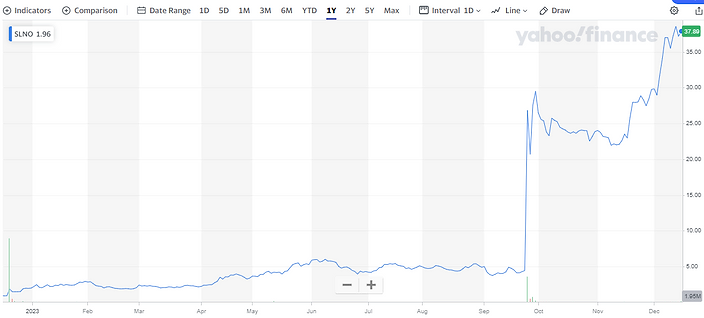

SLNO (7 vs. 1)

9/26/23

Ph3 in PWS (rare disease - hyperphagia - eating disorder)

SLNO 1 yr stock chart

⇨ 1 with an important upcoming readout

CMPS (7 vs. 1)

Ph3 depression - Summer 2024

Only Deep Track had it previously

CMPS pipeline

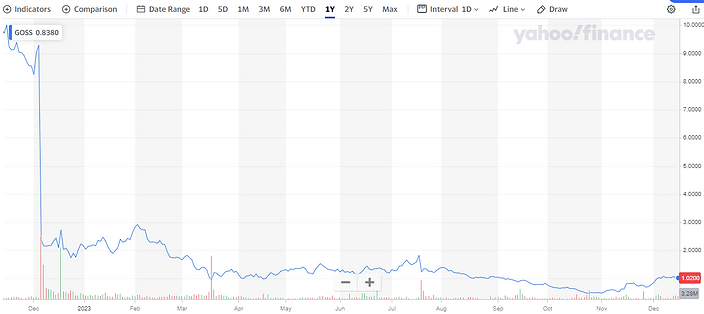

⇨ 1 whose stock was crushed at end of 2022

GOSS (10 vs 5)

Lots of bioHFs for a micro-cap

EV <$200M

4 top 20s is high too

Ph2 update 12/18/23 for only clinical asset

GOSS stock chart

👇 As far as bioHF positions closed,

Not as many closed as initiated

⇨ Most bioHF closed in Q3 '23

Positions closed by 3 HFs

BDTX (5 vs. 8)

VIR (2 vs. 5)

THRX (3 vs. 6)

MRSN (8 vs. 11)

SUMMARY

These tickers are good ones to dig deeper into

Or if you already hold these tickers

take the info above as reinforcing, or a caution

^1 We identified & follow moves of 36 top BioHFs

⇨ That focus on biopharma stocks & have over $250M in AUM

^2 Confirm with your Hedge Fund data provider that there were no holdings for this ticker in Q2 to assure our provider's data is accurate, since the move from 0 to 8 is quite unusual for a company that went public before Q2

This article is not investment, tax, or legal advice. Please do your own diligence and seek advice from professional advisors representing your interests.

Article history:

Posted 12/20/23 (EJV)

Comments